- “Navigating DeFi: The Role of USD+”

- “Exploring the Impact of USD+ in Decentralized Finance”

- “USD+: A Stablecoin’s Influence in the DeFi Landscape”

- “Deciphering DeFi: A Look at USD+”

Introduction

In the ever-changing world of Decentralized Finance (DeFi), stablecoins like USD+ from Overnight Finance have become a beacon of steadiness in the notoriously unpredictable crypto market. USD+, tied to the US dollar (USDC), has quickly become a key player in DeFi due to its dependability and flexibility. Let’s explore what USD+ is and how it can be used to earn in a safer way in the realm of crypto.

What is USD+?

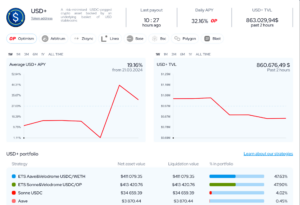

USD+ is a yield-generating stablecoin created by Overnight Finance, a DeFi protocol specializing in delta-neutral yield generation. This stablecoin is fully collateralized and pegged 1:1 to USDC, backed by yield-generating assets. Users can mint USD+ by converting USDC through the official Overnight app, initiating the accrual of compounded yield immediately. The protocol leverages a liquidity index to reflect the ratio of issued USD+ tokens to assets on strategies, enabling the generation of yield through interest, trading fees, and protocol rewards.

One of the key features of USD+ is its rebase token functionality. Holders of USD+ earn passive yield effortlessly, as profit payouts occur through daily rebasing. This provides transparent balance tracking and visibility of profit/loss.

Before diving deeper, it’s crucial to have a basic understanding of DeFi and stablecoins. DeFi refers to blockchain-based financial applications that operate without centralized intermediaries. Stablecoins are digital currencies designed to maintain a stable value, often pegged to fiat currencies or other assets.

How Does USD+ Generate Yield?

USD+ generates yield by deploying underlying stablecoins to third-party DeFi platforms, pooling the generated yield from various sources, and converting it to stablecoins to produce USD+-denominated yield. This yield is then distributed to USD+ holders through a constant rebasing of the token supply, ensuring that the price of USD+ remains pegged at 1 USD while users’ token balances adjust in real-time to reflect accrued yield once a day.

Overnight Finance generates yield from users through proprietary delta neutral strategies and spot+perp strategies. These strategies enable the sustainable generation of yields, without exposure to significant risk. Moreover, they limit the deployment of collateral to high-quality protocols only. This ensures the stability and safety of the investments, further solidifying USD+’s position as a reliable asset in the DeFi landscape.

The Role of USD+ in DeFi

USD+ plays a pivotal role in the DeFi landscape by offering users a stable and profitable investment option in a volatile market. With its focus on delta-neutral strategies and transparent collateral management, Overnight Finance ensures that users can access lucrative yields while maintaining risk management practices. The protocol’s versatility allows it to adapt to changing market conditions, optimizing APYs and maximizing returns for users throughout its lifespan.

Moreover, USD+ offers yield farmers a unique advantage over traditional stablecoins. Its stable value and rebase token functionality allow holders to earn passive yield with daily rebasing, reducing exposure to crypto volatility. This could enable higher earnings compared to traditional stablecoins, positioning USD+ as a transformative asset in the DeFi landscape.

How to Use USD+ to Earn in DeFi

To use USD+, you have two main options.

- Liquidity Provision and Yield FarmingProviding liquidity with USD+ to decentralized exchanges (DEXs) or liquidity pools is one way to earn. As a liquidity provider, you contribute USD+ to a pool to facilitate trading on the platform, earning transaction fees, and DEX token emissions in return. Yield farming with USD+ is another method, involving staking or lending your USD+ tokens in exchange for interest or rewards. Since USD+ maintains a stable value, it is an attractive option for those looking to earn passive income without exposing themselves to the volatility of other crypto assets.

- Passive HoldingAnother way to earn with USD+ is simply by holding it in your wallet. Thanks to its rebase token functionality, USD+ holders can earn passive yield from daily rebasing, without doing anything else. This is an ideal strategy for those looking for a hands-off approach to earning in DeFi.

Liquidity Provision and Yield Farming in DeFi

To start earning with USD+, you can participate in yield farming opportunities on platforms like Aerodrome Finance. Here’s a step-by-step guide on how to get started:

- Visit the Overnight Finance website and connect your wallet.

- Choose any USD+ pools from the list of available options.

- Enter the amount of funds you wish to convert into LP tokens.

- Confirm the transaction in your wallet. The Zap In feature will automatically calculate the correct proportion for you, making the process easy and straightforward.

For those looking to maximize their earnings, Overnight Finance also offers the Zap feature, which converts your funds into LP tokens in a single transaction, saving you the hassle of buying each token separately and adding them to the liquidity pool. This method is particularly user-friendly and perfect for beginners.

Using USD+ in your DeFi strategies provides several advantages. Its stable value reduces the risks associated with price fluctuations in the crypto market. It ensures that investors can easily enter and exit positions, providing a fluid trading experience. Moreover, USD+ supports a wide range of DeFi applications, from yield farming to lending and borrowing, making it a versatile tool in the DeFi space.

Conclusion

USD+ represents a significant advancement in the DeFi space, offering a stable, risk-minimized asset that is fully collateralized and can be instantly converted into USDC. By participating in yield farming and staking opportunities, users can earn passive income while benefiting from the protocol’s conservative risk management strategies. Whether you’re a seasoned crypto investor or a newbie, USD+ provides a range of options to suit your level of expertise and investment strategy. By integrating USD+ into your DeFi strategies, you can leverage stability to navigate the exciting yet unpredictable world of decentralized finance in a risk-averse manner. Remember to always do your own research and only invest what you can afford to lose. Happy farming!